Harley Davidson Financial Analysis

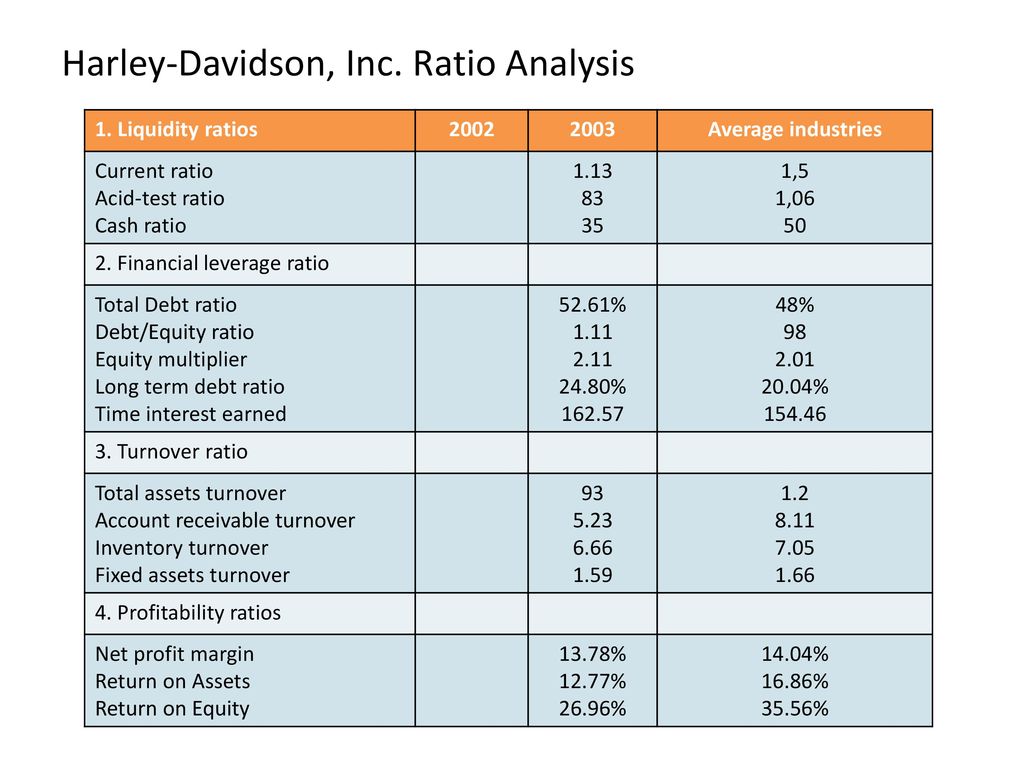

This will be 100 for a firm with no debt or financial leverage.

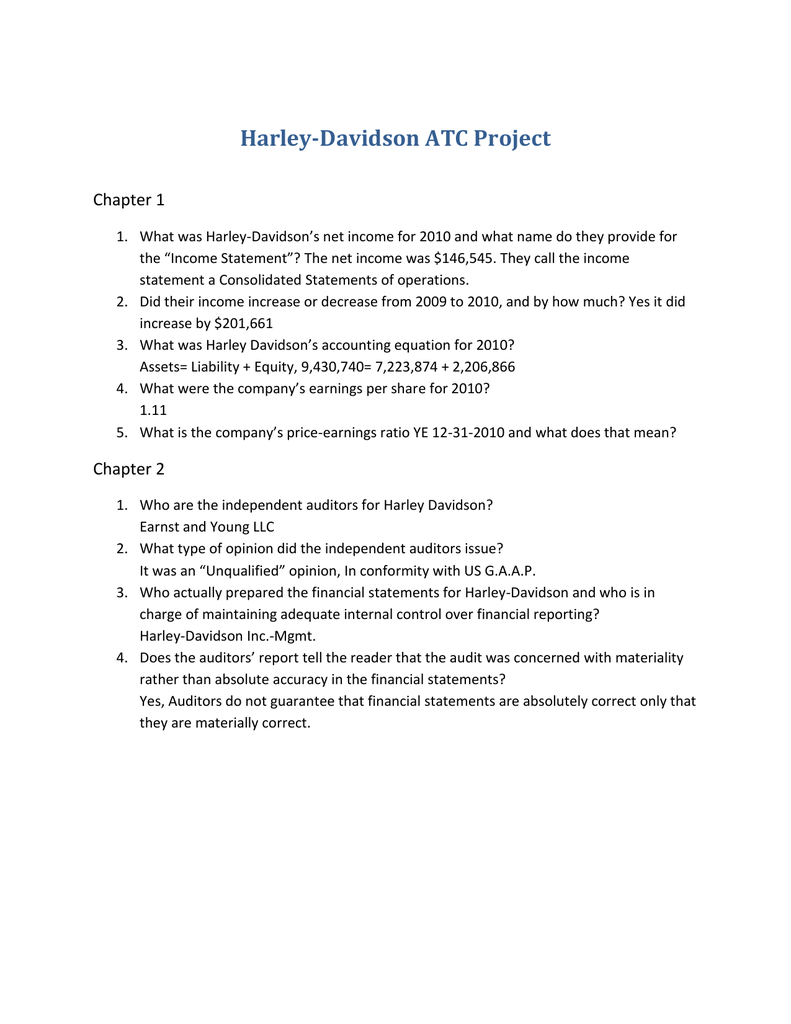

Harley davidson financial analysis. Financial ratios and metrics for Harley-Davidson Inc. Its consistently high current and acid-test ratios prove that in the short run the company is in a strong position to meet its obligations which would be especially useful in the case of another economic downturn. Internal Analysis Financial Analysis Harley-Davidsons financials are a key component on internally analyzing Harley-Davidson and how well they are performing by.

Harley-Davidson manufactures heavyweight motorcycles as well as a complete line of parts apparel and accessories for motorcycles. Income statements balance sheets cash flow statements and key ratios. EBTEBIT The companys operating income margin or return on sales ROS is EBIT.

2018 Harley Davidson financial analysis. Check the Dupont Ratios Analysis of HOG Harley-Davidson Inc. The primary business activity of the company is Motorcycles Bicycles and Parts SIC code 3751.

Two Views which includes analysis of your findings15 points. The need to expand globally is fueled by the companys financial situation. Harley-Davidson designs manufactures and sells heavyweight motorcycles.

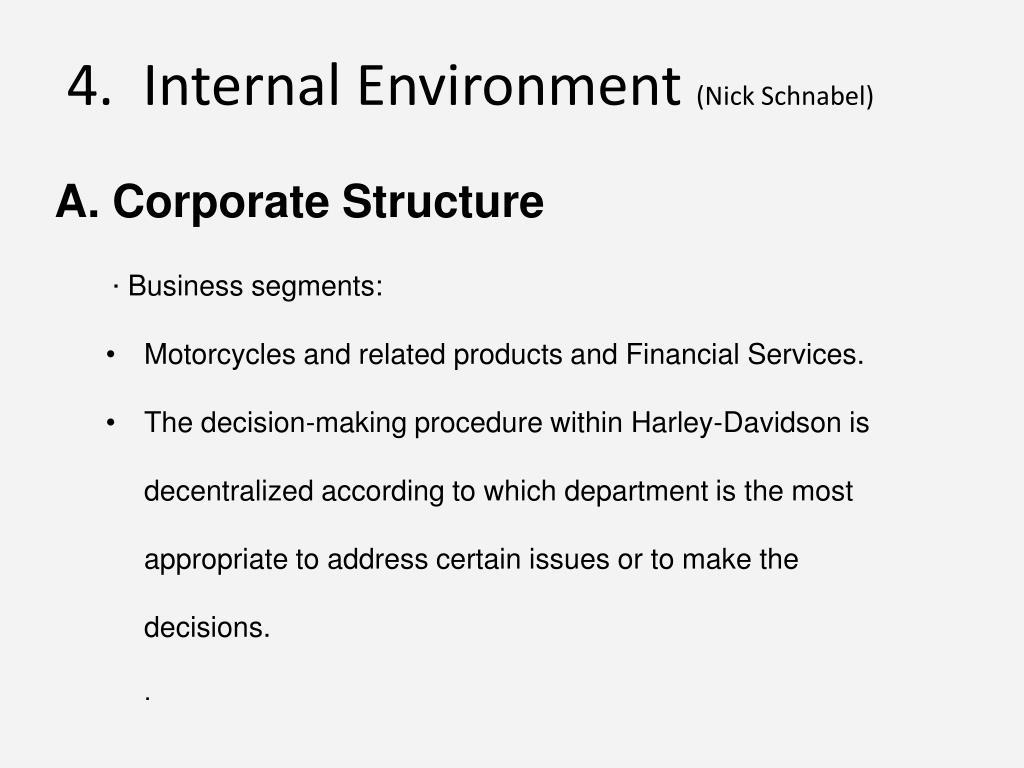

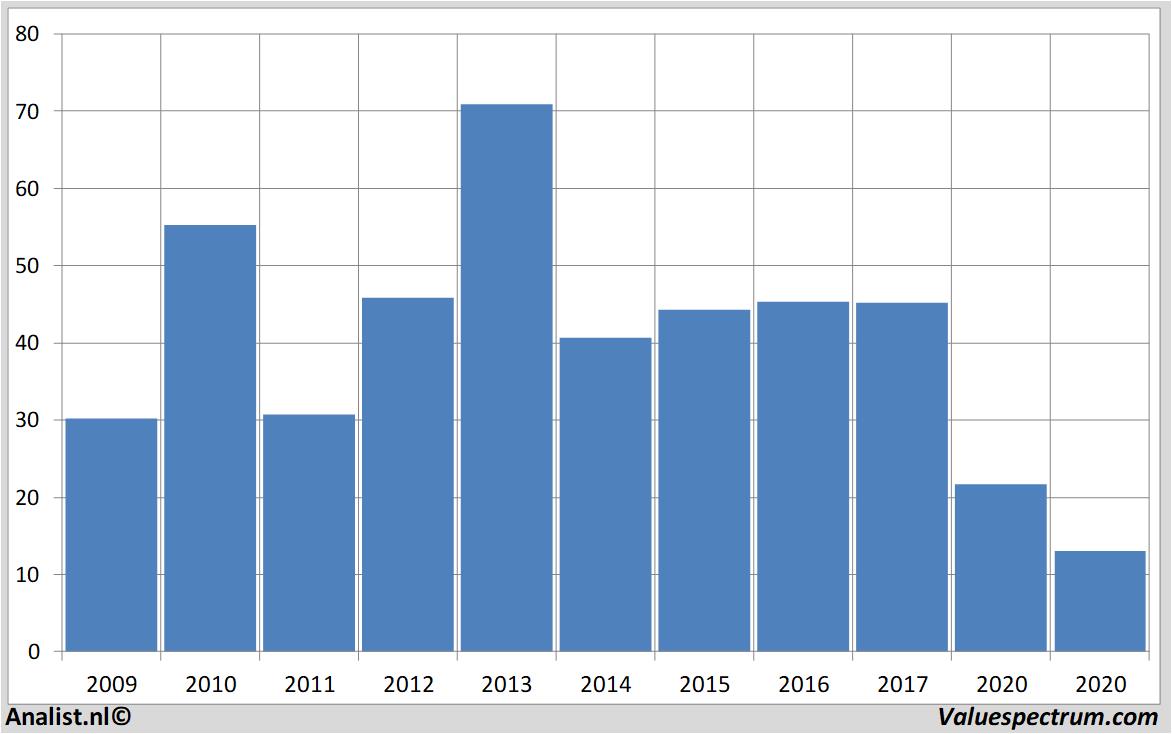

It operates in two segments Motorcycles and Related Products and Financial Services. A Strategic Audit Analysis. The EVEBITDA NTM ratio of Harley-Davidson Inc.

Harley Davidson Strategic AuditPresented to. Performed a ratio analysis of the financial performance of two competitors and compared them to H-D. The company markets its products in North America Europe AsiaPacific and Latin America.